Sure, we all want ‘affordable’ rentals ...

But when it comes to ‘free enterprise,’ what's free? Nothing. Ask Ronnie Bourgeois.

What does it take to create rental housing on Cape Cod that might come close to working class affordable?

Let’s not talk non-profits relying on grants, foundations and philanthropy.

Let’s talk market reality, upfront investments, bleeding cash flow cauterized by long-term margins.

Let’s talk zoning, town planners, lawyers, architects, engineers, contractors, then the landlord responsibilities and tenant hassles that attend success.

Let’s talk wherewithal, credit, who’s willing to risk high blood pressure to navigate economic potholes, detours, hairpin turns — all for the gambler’s promise of profit on the horizon.

Let’s go to Barnstable Road, Hyannis.

Let’s talk to Ronnie Bourgeois.

Ronnie is a self-made guy I’ve visited before (The real housing deal), a major player in the rental market on Cape Cod.

It hasn’t always been this way. Now 59, he bought his first duplex off-Cape at 18 years old, “and I thought I had it all figured out,” he remembers, parlaying, expanding — until he busted at 27.

He clawed his way back at Bass River Properties in Dennis (now Hyannis) in his 30s, sleeping in the office, living on $25 or $30 annual grand, relying on rapid-fire delivery and stubborn perseverance, surviving divorce, focusing on “the low end of the market.” One deal led to another until nowadays he owns about 200 units, rents and takes care of another 120 or so properties across the Cape.

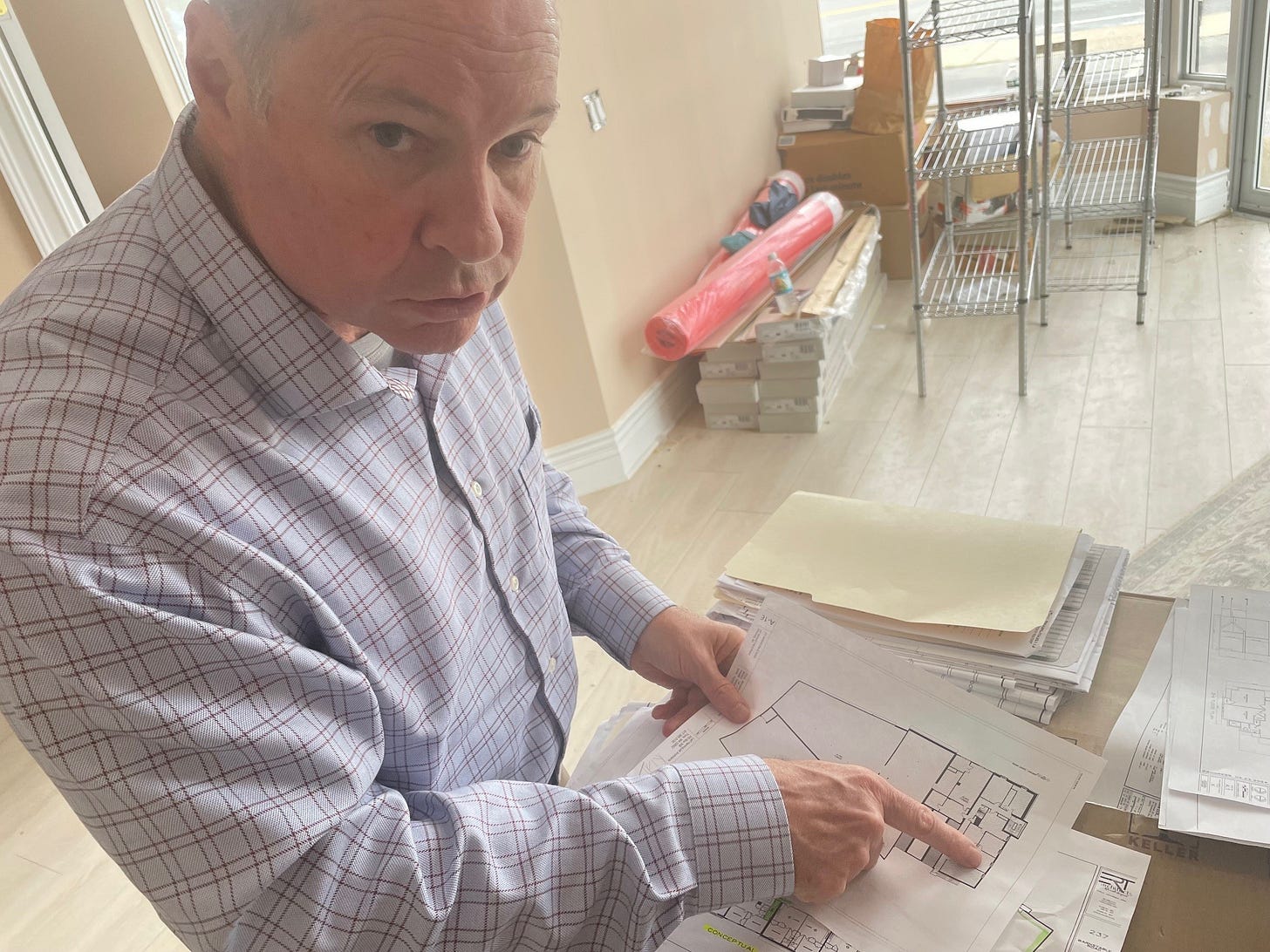

Like any shark — this is a compliment — he’s always moving. In August, 2020 Bourgeois struck: He bought 235 Barnstable Road, a former furniture store now home to Carpets of Cape Cod and Party Express Rental, 42,000 square feet on the artery between the airport rotary and downtown Hyannis.

He also snagged an adjacent vacant lot, 24,000 square feet, 139 Grove Street. In 2023 he added another small lot (5000 square feet) on the other side, 239 Barnstable. And then, “just to make it all that much more interesting,” when he realized there was a paper road running through the property that could impact parking, he bought a residential lot behind with a single-family home he’s renting out, 280 Winter Street, also in 2023.

Let’s add it up: $1.5 million for 235 Barnstable, $200,000 for Grove Street, $220,000 for 239, plus $425,000 for Winter Street “basically to protect parking,” says Ronnie, cocking his head a little. That’s north of $2 million.

Here’s why this made sense:

The main building with the carpet store, 42,000 feet, is two stories, the upstairs not used much except for one office and lots of display storage. Ronnie and attorneys studied zoning regs, architects and engineers worked and reworked plans, an exercise costing another $100,000 or so. They figured he could parse 14 apartments on the second floor, mostly one-bedroom, a few two-bedroom, with commercial rents remaining below.

It’s a steroids version of the mixed-use model that helped small-town Main Streets thrive once upon a time; storefront on the street, housing above. And renovating existing structures, rather than eliminating open space, is a strategy regulators prefer.

But each unit would need one off-street parking space to qualify. Even after buying Winter Street, Ronnie could only come up with 13 spaces plus what the commercial first-floor requires.

OK, make it 13 units, and say two of them need to qualify as affordable housing to pass muster for higher density. Fine.

Then let’s say the cost to renovate — punch out a window for every bedroom, plumbing, wiring, kitchens, bathrooms, stairwells, hallways — is $150 a square foot. Then look at what the open market is bearing for rentals, reserving two apartments as “affordable” to garner zoning breaks.

Ronnie’s target for rentals became $1750 a month times 13 — an average allowing for less for “affordables,” more for two-bedrooms.

That’s $22,750 a month, fully occupied. Plus, there’s income on the commercial first floor.

Could he find tenants to pay that?

Yes.

Will it involve management headaches down the road?

Yes.

Now turn around and take the tenants’ perspective:

One-third of income on rent is considered a healthy, secure position, though these days no longer the norm. Yet aspiring to that means per unit, someone would need about $70,000 annual income.

Split between a couple that’s fine; for one person that’s beyond the far edge of “affordability” — even making $1000 a week doesn’t get you there. But this is as close as the open market is going to get (remembering two of the 13 likely will rent for less).

Ronnie has been working on iterations of this idea since 2020 — carrying overhead all the while. Thing is, he got sidetracked by the shiny baubles that are the vacant lots:

Grove Street could support as many as 24 units in three new three-story buildings, while the small lot on the other side, 239, could hold four units, again each with an affordable component to allow density.

But building from scratch is a lot more expensive than renovating. Plus eliminating open space, even in Hyannis, is a tougher sell.

So Bourgeois has pivoted back to the main building first, pushing plans, hoping by September or October to secure permits. Then he’ll go after approvals for the vacant lots.

“Capital, expertise, and wherewithal, it takes a lot to get to this point,” he muses. “How many people could make a project like this happen? How many would be willing to go through everything necessary? Not many. Plenty who have the capacity wouldn’t bother.

“I’ve just kept at it so my dreams of grandeur won’t be crushed,” he guffaws.

There is a bright financial light (aka return) at the end of this tunnel. But it’s a nerve-wracking route. People call this “free enterprise,” but there’s nothing free about it.

Ronnie understands that full well; he would prefer if town planners could simplify and expedite rather than complicate, but he knows they have different motivations than developers. They represent public priorities like affordable housing and open space. Those usually run counter to maxing profit.

Yet he’s ambitious, stubborn, restless, and so he’s in the dance:

Propose more units. Make more plans. Attend more hearings. Adapt as necessary. Downsize if you must (so long as it still cash flows). Write more checks. Keep running the numbers. Don’t freak out.

This is what the “open market” really looks like.

Haven’t subscribed yet? With all due respect, why not? Make it possible to see a Voice and support good reporting, strong perspectives, unique Cape Cod takes every week. All that for far less than a cup of coffee. Please subscribe:

https://sethrolbein.substack.com/welcome

And if you are into Instagram, want to see some additional material, maybe share the work, here you go:

My 29 yo daughter with a Master’s Degree, working 3 jobs can barely afford her rent. Nevermind health insurance, car insurance, utilities, parking, and oh yeah … food. If she had student loan debt, she’d be up the creek. And the rent goes up every year. Thats what we left this generation of young adults just getting started. It’s a damn shame.

When was the last time there was writing of this clarity and import about critical issues on Cape Cod? Oh, I remember. That was when S Rolbein edited the full paper version of the late and lamented Voice. We are lucky he is still at it, telling us what's new, interesting, and important, always with style.